2019 Annual Review

Another year passes and I grow a little older (and hopefully wiser). My now wife and I rang in the new year in the emergency room at the hospital. It was a horrible start to 2019. But when you start a year like that, things can only improve, and boy did they. This year was a big one for me. I got married, had a second kid and turned 40.

I’ll go over the major parts of my life. Family, health, travel, business, betting, investing and everything else.

This is now the 6th yearly review. You can read the other ones here. 2013, 2015, 2016, 2017, and 2018.

The major goal

This has not changed since 2010 when I started this blog. So I’ll simply copy and paste from last year.

When I started this blog in 2010, my goal was to try to make a profit from betting which would allow me to retire early. At the time there was no word/description for someone retiring in their 30’s. Over the past 9 years, the FIRE (Financial Independence, Retire Early) movement has started and just last year I noticed a massive number of articles about it. I’ll copy what I wrote last year about our major goal.

Our families dream life requires $80,000.00 a year. This includes travelling for at least 3-6 months every year. There are a heap of great retire early blogs and calculators, but in short, I am using the 25x rule (or the 4% withdrawal rate). All you need to do is take what you will spend each year and times it by 25, this will give you the number you need in investments to be financially secure for the rest of your life.

$80,000.00 x 25 = $2,000,000.00

So I need $2 million in investments (stocks, bonds, property, betting, startups, so on) to be able to stop working (if I choose). These investments should return 7% on average and I can withdraw 4% ($80,000.00) each year and the other 3% covers inflation. There’s a heap of complexities to it, but that is the general idea.

My goal date to hit this number is in 2027 when I turn 47. I already live what is my dream life, I travel whenever I want, I work on projects I find interesting and I get to spend time with my family. So even when I can “officially” retire, I doubt I will be doing anything different.

To achieve this goal, I try and make money via numerous means. These are (in no particular order)

- Betting

- This blog (affiliate income)

- Dailyprofit (membership site)

- Investments (stocks, property, angel investing, cryptocurrencies)

- My own projects

Let’s get started with the least important one. How did I do financially this year?

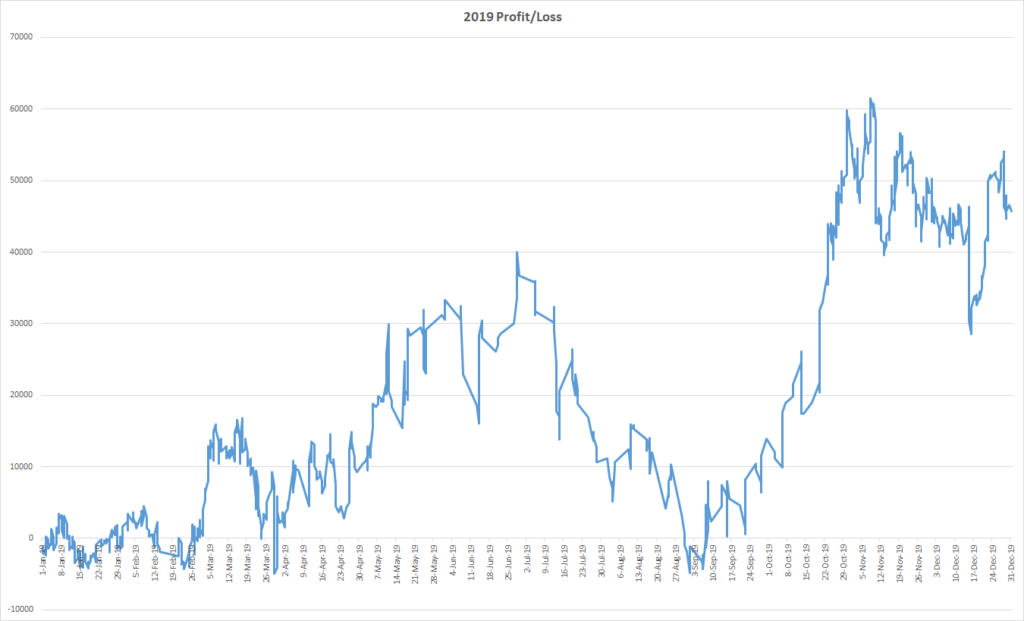

2019 Betting profits

In 2019 I turned over $1,492,490.00 and made a profit of $45,740.00 at a 3.06% ROI. Each year I am betting less and less. I’m sure you have noticed, but betting doesn’t take up a lot of my time these days. In the early days, I would post weekly and work 80 hour weeks researching/learning/testing new ideas. It was all new to me and I had a real thirst to learn and succeed. 4-5 years ago I figured out what works for me and have been happily spending barely any time these days betting.

For the last several years, I have only followed the Sportpunter models. It was the one model that consistently made good profit and had stood the test of time. It also feels great that everyone who is a member of the Dailyprofit service is in the same boat as me and bets exactly what I bet. So when I have a winning year, they do too.

I placed 991 bets and won 510 of them, lost 476 and 5 were refunded.

The total time I spent betting (the most important metric to me) was 72 hours combined (I used Rescuetime to track this). During the NBA/NFL season, it takes me a few minutes per day to place my bets. That works out to an hourly rate of $635.27

A similar pattern has emerged over the years with the Sportpunter models. Early season profit followed by late-season losses for most sports.

The first two and a half months of the year were all NBA. By the end of March, the NBA was up $19,360.00. The NRL started mid-March and had a terrible first few rounds, losing $16,380.00 across 17 bets. But from April, both the NRL and AFL models starting making some decent profits. Between April and June, the AFL made $16,570.00 at 14.6% and the NRL made $23,410.00 at 15.2%. The second half of the footy seasons, on the other hand, were not good. From July to the grand finals in late September/early October, the AFL lost $17,670.00 at -20.1% and the NRL lost $15,360.00 at -16.0%.

Over the entire 2019 season, the AFL made just $130.00 profit at 0.1% and the NRL lost $8,330.00 at -2.8%. With 2020 vision (see what I did there), I’ll be betting these models up to the end of July and then waiting for the NFL and NBA seasons to start.

The American sports have been the golden goose for the last few years. You can see the exact day they begin by looking at the graph. After 9 months of betting, I was sitting on a loss (-$4,810.00). The NFL kicked off on September 5th and started an upward journey to $20,000.00 profit. The NBA joined in on the 22nd of October and within a month I had hit an all-time high for the year of $61,550.00. The last few months of the year was a bit of a rollercoaster and I ended the year with $45,740.00 profit at 3.06% ROI.

You can see each monthly review below

- January+$1,610.00

- February -$200.00

- March +$790.00

- April +$7,030.00

- May +$21,940.00

- June +$5,510.00

- July -$26,010.00

- August -$12,480.00

- September +$15,710.00

- October +$43,270.00

- November -$8,940.00

- December -$2,490.00

We can now have a look at each individual model and how it performed.

| Sport/Bet Type | Wagered | 2019 Profit/Loss | ROI |

|---|---|---|---|

| AFL H2H | $221,990.00 | $130.00 | 0.1% |

| NRL H2H | $293,760.00 | -$8,330.00 | -2.8% |

| NBA Totals | $635,670.00 | $35,460.00 | 5.6% |

| NFL Totals | $233,610.00 | $5,200.00 | 2.2% |

| NFL Line | $98,210.00 | $15,150.00 | 15.4% |

| MLB Totals | $9,250.00 | -$1,870.00 | -20.2% |

| Total | $1,492,490.00 | $45,740.00 | 3.06% |

My goal each year is to make between $50-$100k and this year performed adequately. In 2020 I’ll likely bet just over $1 million and hope to hit a 5% ROI.

Investment portfolio (stocks)

The ASX put on 21% this year. The money I left in my account achieved a higher return, but like the classic idiot, I thought I could time the market (and I still do). I wrote an article about why I was selling 40% of my portfolio and what I was going to do with it. That decision midway through the year has cost me well over $100,000. I see the market continuing to make gains in 2020 as all governments around the world keep printing money. But I still have a strong conviction that I will be right in the long term. So I do the thing that I can do better than 99.999% of the population. Sit and wait.

Cryptocurrencies (Bitcoin)

My predictions for Bitcoins price have been pretty good over the past 4 years. In 2016 when Bitcoin was about $1,000 USD I assumed that it could double each year, meaning at the end of 2019 it would be sitting around $8,000 USD per coin. I was not far off. But 2020 will be a huge test. My assumption now means by the end of this year, it should be close to the $16,000 USD a coin mark.

Bitcoin started the year at $3,800 USD and ended it at $7,250 USD. It hit a high of $13,200 USD in late June. It’s low was around $3,300 USD. Last year I said:

It is now very close to what I feel it’s value should be ($4,000) and I’m looking for it to double again this year to end at $8,000. I had multiple buy orders ready at $3,000 and will happily buy a few more coins if we hit that number again.

My buy orders were so close to triggering, but it didn’t quite get there. At this point, any extra coins I buy will have an immaterial impact on my Bitcoin profits, so I’m happy to keep the coins locked up for a few more years.

We still await the killer app for crypto.

Angel investments

This was the year some of my bets i placed in 2014 started to turn into real winners. Angel investing usually means waiting 10 years to get less money back than you started with. It is high risk, high reward investing. I do not expect to see $1 until at least 2024 when some of these companies might IPO or be bought out by even larger companies.

This year I also lost big on a few. One health-based company that I had invested over $15,000.00 (from seed to series A) was acquired by a competitor. I received about $2 for each $1,000 invested. A few other companies simply shut down or turned into zombies.

With Angel investing, you only need 1 to hit to win big. I managed to get that 1, and a few more. These are still only paper gains and these companies are still very high risk and could go bust in the next few years. So I can’t count my chickens yet.

But this year I have hit a 375x gain, a 40x gain and a 20x gain. These 3 companies have all raised funding from the biggest VC funds this year and these VC funds expect at least a 10x return from here.

To put it in perspective, for every $1,000 I invested in the 375x company, I’ve made (on paper) $375,000.00. If the company ever goes public, I’ll need to pay 20% carry, capital gains tax and so on, but it is an incredible return no matter how you look at it (and could 10x again from here).

The next few years for these companies will be very interesting.

Affiliates

Boy has the affiliate industry died a stinky death in Australia. Ladbrokes/Neds changed terms midway through the year to try and make affiliates leave. When that didn’t work they simply closed all small affiliate accounts. I had sent well over 140 customers to Neds and they simply used a term in their T&C’s that said, “we can close your account at any time without any reason”. Playup was even dodgier when moving 400+ affiliated players from Madbookie. They simply stopped reporting numbers, didn’t pay me what was owed by madbookie and then closed my account.

This site now only has bitcoin-based bookie advertising. Only a few readers have taken the plunge into Bitcoin books, but the numbers keep growing.

I see a year of consolidation for Australian bookmakers. I’d be surprised a few more books don’t shut down or merge. Australian punters are getting a very raw deal at the moment.

Dailyprofit

Dailyprofit.com.au is my stable source of income. It just about covers my yearly expenses and does not take too long to update each day. After some Twitter posting in the middle of the year, we reached 160 members, this number was a little too high and the site kept crashing and prices were dropping very quickly. The sweet spot seems to be around 130 members. From the beginning, I have grandfathered in members. That means some members are paying $39 for a service that now costs $139 a month. I’ll be changing that structure this year and that will allow me to keep running the service with fewer members.

2019 Investment conclusion

My major mistake this year was breaking my number one rule of doing nothing. I thought the world was on the brink of recession and that stocks were going to collapse. I was wrong about the length the worlds reserve banks will go to to keep the economy going.

This was another fantastic year of paper gains. Actual money going into my bank account was enough to cover living expenses and allow for some more investing.

Projects (Punt101)

I finally released a very basic MVP of Punt101 earlier this year. As soon as I launched, Pinnacle shut off my API access and my programmers moved on. But launching that version was the best possible thing. I’ve now had over 400 people create an account and many have given great feedback. I’ve also found 2 Aussie programmers to help part-time to get it working again. To top it off, I’ve now got a Pinnacle feed once again.

You can expect the site to be ready in the next few months and 2020 will be devoted to building out the basics and talking to all of you about what you want out of the product.

I’ll also be starting a weekly sport betting related newsletter this year to compliment the site.

Travel

The slowest travel year for me since I took my first plane ride at 26 (I was a slow starter). This year I went to Melbourne for my bucks party and had a family trip to Adelaide. 2020 will also be a slow year as my son starts his first year of school. I have a trip to Perth booked and might try 1 small overseas trip later in the year. I had planned for 2020 to be a massive year.

Life

Life

This is just an excuse to post another photo of my amazing wife. After 9 years together we finally got married. About 9 months later (yes, yes) we welcomed kid number 2 into our little family. At the end of the year, I also turned 40. I really fit all the big things into this last year. I started this investing/betting journey 4 days before I met my wife. I can’t believe everything that has happened in those 9 and a half years, but I am so thankful they have.

Health and Fitness

I feel I should rename this section to “How I failed again”. My low of 2019 was 90 kilos at the start of the year and my high was 102.5 kilos. I applaud anyone (including my wife) who can stick to a keto diet. It clearly works, but requires a huge amount of dedication. I once again let myself go in the festive period and ended the year at 97 kilos.

We go again in 2020.

What a year

1 year is now just 2.5% of my life, so each year feels shorter and shorter. A summer break when I was 10 would have felt the same amount of time as 1 year does now.

I can feel a real difference between the 30-year-old who started this journey and the 40-year-old currently writing this. If you are young and thinking about chasing a dream, do it right away. The amount of energy you have will slowly fade over the years.

Even though I am an old man now who has a bad back and less energy, I am happier than ever. I’ve loved the last 10 years, and am so happy with my life and family. I can’t wait to see what the next 10 years will bring.

I hope your 2019 was amazing and here is to a fantastic 2020.

Life

Life

Thanks for writing this! I can’t imagine how inspiring these words must be for youngsters. As another 40yo bloke, I can relate to pretty much everything you said here. Two questions about angel investing: Didn’t you get involved in new ones since 2014? And where/how did you get involved (personal meetings, online, e.t.c.)? Congrats and here’s to an even happier 2020!

Thanks Jim, this is a classic case of if this idiot (me) can do it, so can you. I’m not sure if I tried to replicate the last 10 years again I would have the stamina.

I used angel.co and followed people smarter than me (Calacanis, Naval, Ferriss, Others).

I invested from 2014 to 2016 and have just been reinvesting in future rounds.

I decided to wait out 10 years, see what my returns would be and potentially do more in my mid-40s. So still waiting for the experiment to end. But it looks like I hit a home run on my first go (beginners luck) and if I continue I might be chasing that elusive unicorn again for the rest of my life.

Hey Steve, great write up as always, every year I look forward to this.

Out of curiosity, how many people visit the daily25 site every day?

I always thought it would be Daily Profit Members + a few more, I’m quite impressed how well you monetise this blog

Cheers,

Sam

Hey Sam,

This site barely gets any views these days. Usually just over 100 visits a day. When I post a new article it goes up to around 1,000 views. Back in the early days when I was blogging every few days, it would average well over 1,000 visitors a day.

The site makes very little on its own, but most members of Dailyprofit first find this site and then join the service, so really, all of Dailyprofits earnings come from this site.

Fantastic article Steve!

Hi Steve,

You are an inspiration. Still don’t know how I got into an Aussie website being so far away, but glad it happened. Wish all the best to you and the family. Looking forward to follow your steps this year.

Cheers !

Thanks Reece

Hey Joao,

Thanks, hope you have a fantastic year as well.

Well done Steve. Always of great interest to learn how you have fared at the end of a year and nice to see once again that you have finished in front. Best wishes for your continued success into 2020 and beyond.

Kind regards,

Thanks Brian.

Another great post and annual update Steve . Although I am not a paying member, I have been a subscriber for multiple years now. I have always appreciated your transparency. Very hard to come by in this industry. Wishing you and us all a prosperous 2020!

Thanks Lewis. Hope you have an amazing 2020 as well.

Thank’s for sharing Steve. I’m from Brazil and I follow each year’s review. I’m now the 30 years betting guy, and I learned a lot with you. This year I leave the tips, 3.5% ROI it just didn’t pay the work. I also believe in bitcoin, and stocks. You should take a look in Brazilian stock market, looks great.

Have a great year, you have a amazing family,

Thanks Jallin,

I’ve been looking at emerging markets. But as I have no real advantage over anyone else, I will stay away from them.