Dailytrades: Real users experience month 4-5

This is one of our Dailytrades members experiences using the service. This review is from the 7th of June until the 8th of August. You can read the 1st monthly review and month 2-3 review. The Dailytrades service is your own personal tipster who gives you hundreds of bets each week that beat the pinnacle closing line. It has been shown time and again that beating the Pinnacle line is the key metric in making a long term profit. That is exacly what this service does.

Dailytrades is $50/week or $175/month and gives you access to all Australian and European bookmakers.

Dealing with Variance

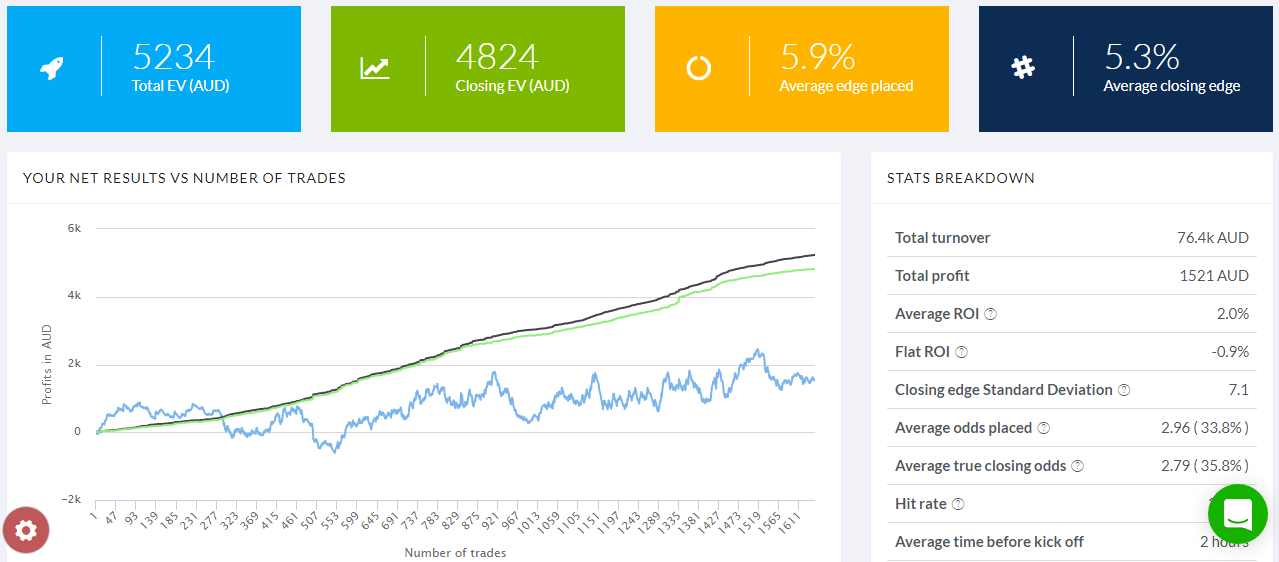

Figure 1. Total Trades Made.

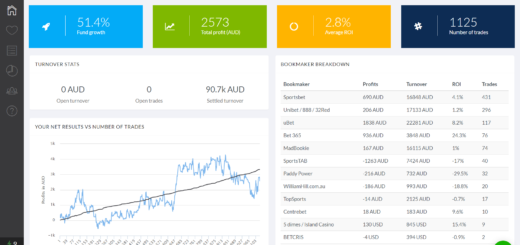

Stats

Starting Balance: $2400

Bets Placed: 1646

Turnover: $76,400

Average Wager: $46.4

Total Profit/Loss: +$1521

*Disclaimer* These profit totals do not include any arbitrative bets made utilising this tool.

Hello World! Today I provide the latest update on my sports trading using the DailyTrades tool.

In my last post, I discussed trend analysis, citing that the ‘4 & 2’ rule appeared to be an algorithm that best lined up with the trade’s expected value. Whilst this rule, for the most part, has sustained, the variance is a factor that’ll always play its part. In fact, it can move an ROI from 2 to 3% in as little as 20 trades, and back again. After the sports breakdown, today’s discussion will revolve around a crazy two weeks on Dailytrades and readings to make you a significantly sharper trader.

Sport Breakdown

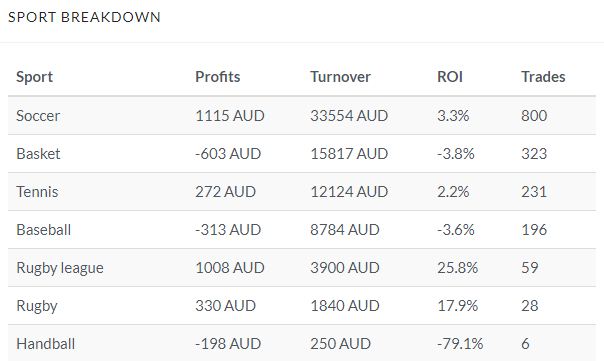

Figure 2. Sport Breakdown

Over the last two months, there has been less trading than usual. This is largely due to the odd space in the sporting calendar where there was no major soccer event over the offseason. This won’t be an issue in 2018 with the World Cup on the horizon, but it did make for a quiet period over the past couple of months. However, the US Open, MLB and NRL still allowed for a level of turnover. As discussed in the last post, I’m still running heavily positive with rugby league which is a direct consequence of the luck involved in variance. Over the proceeding 100 trades, I expect these numbers to level out substantially, much similar to the heavily traded soccer.

Something yet to be discussed on this platform is how to deal with the lesser-known sports or competitions. This may be handball, which is an almost unknown sport in Australia, or it may be simply an unrecognizable name on the Challenger circuit. DailyTrades has a feature to differentiate between the common and uncommonly traded sports. This system is handy to quickly articulate what is worthy of looking at and which is not. For instance, when I began my trading on the platform I searched for that which is most obvious, the greater edge. With hindsight, this was an oversight.

Trading these lesser-known markets can be advantageous but does come with implicit risk. For instance, you’re more likely to be banned or limited as betting companies fear the potential arbitrative punter. The other risk is the lack of basis that these trades may or may not have. Using the Pinnacle website, it’s quick and easy to identify how much the company is accepting on each sport. The more they’re willing to accept, the stronger the company is in those numbers. My general rule of thumb is to not trade a market in which Pinnacle is accepting less than $2,000. This verifies that I’m not involving myself with dumb money and am only accepting the wisdom of the crowd.

The Fortnight of Variance

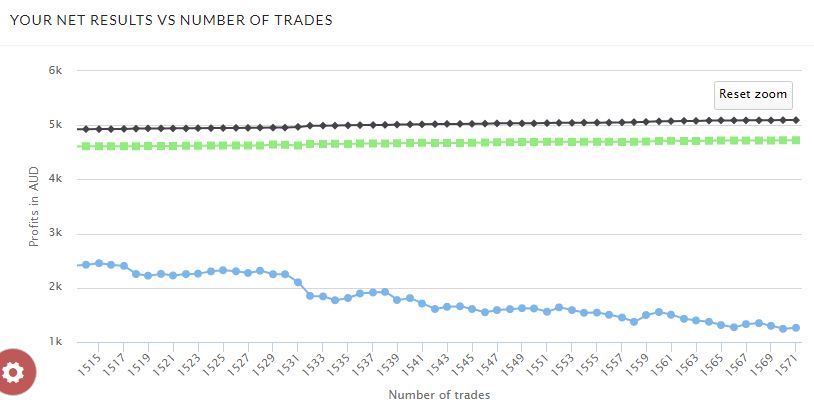

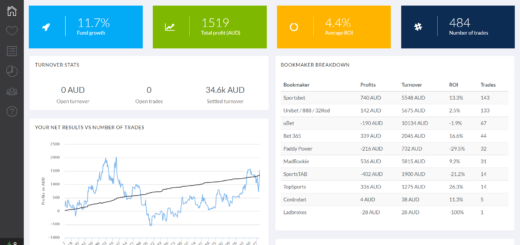

Figure 3. Variance in 50 trades or less.

This may not look like a cataclysmic drop in the graph, but let me provide you with some numbers. The top of this slope is a net profit of $2424 from the 1516th trade. By the 1570th trade, that number was whittled away to $1243. In effect, $1181 were dropped over 54 trades or 3% of the total trades made. Similarly, a touch over $1400 was made in the prior 70 trades. These trades were made over a two to three-week period. During these types of periods, it’s vital to learn but also maintain your efforts. Jonas Gjelstad has gone through periods of significant losses. However, as he suggests through in the linked series, avoid recklessness at all costs and in the long-term the numbers will even out.

Variance is a large part of the game and this is an element not suited to the faint of heart. As most in the betting world are aware, there are always going to be significant up and down swings. The testament to this is the graph above. This was my third $1000 downswing. The beauty is that with every time you live the roller coaster one way or the other, you become a little more process focused, and a little less emotionally driven. As long as the process is correct, you should maintain confidence in the long-term course of events.

Sharp Trading Knowledge

As with all that life has to offer, when you stop learning, your results will suffer. As the data suggests, I’m heavily involved in trading the world game. Keeping your ear to the ground can help you determine the level of confidence you have in each opportunity. For instance, Twitter accounts such as Michael Caley’s expected goals or Stats Bomb provide a continuous drip feed of data-driven football analytic material. Sometimes the Boolean end result may not be the greatest indication of how the match played out. If you can have a greater awareness of these factors, you may have greater knowledge than most in the market. Spending some time each week learning objectively about the sports you trade will have a positive long-term effect.

Conclusion

This is a very exciting period to be trading sports. With La Liga, Bundesliga, Serie A, Ligue 1 and the Premier League back, there are high volume opportunities around the clock. Last Saturday night I had 20 live trades at one point and I’m sure many had plenty more. Whilst the week to week of trading can be a rollercoaster ride, the long-term is providing a slow upward trend. I look forward to next month’s post where we’ll hopefully break through the 1800 trade threshold. Till then, may the variance be on your side!

As you can see, our members continue to make a profit and this member is already at 63% bank growth. This member’s returns are way below the average return for members. Imagine having a tipster service where you are almost guaranteed to beat the Pinnacle closing line on every bet. Dailytrades is that service.

Hello,

Going by the report it seems a lot of effort (over 1600 bets) for a return of a little under $130 per month. In fact the last two months show a loss of -$15

As the flat ROI is -0.9% the staking method (Kelly 50%/30%)has been the means of profit.

Hi Peter,

The last few months have seen much less sport (no Soccer). This is also just 1 of many members breakdowns. We have members who are now over 20k profit (and others that are slightly negative as well).

The key with any product you purchase is the return you can expect from your bank. As this is a product for more advanced bettors with a fairly high price tag, you also need a bigger bank (It can be done with 1k, but I would advise a $4k bank to make sure you cover subscription cost and make a very healthy profit).

Yes, Kelly staking is there for a reason on our platform. It works.

I think this user will do well over the coming months with the European soccer season in full swing, but I will also look to post a roundup of other users results as well.

Cheers

Steve

Hello Steve,

Now that you have posted a shot of your latest DT for this to be really informative it would be good if we could see a screen shot of both yours and the anonymous subscribers settings and the Kelly % staking being used.

We could then compare this with the settings suggested by Marius for the soft books.

I’ve just received the dredded email from Marathon Bet: “We regret to inform you that MarathonBet has taken a decision to withdraw its online betting and gaming services for all residents from Australia for the foreseeable future.” Is this the beginning of the end?